Hedging for Warm Winters

Written on: August 7, 2023 by Phillip J. Baratz

Hedging the weather can be one way to weatherproof your business.

If it’s not one thing, it’s another.

For the past 3+ years, this has been our collective reality—COVID-19, quarantine, a weak economy, supply-chain issues, more COVID, political strife, the Russian/Ukraine war, rising interest rates, warm weather… and the beat goes on.

While we’ve struggled in the retail energy sector, we’ve continued to sell essential products and services regardless of whether people were stuck at home or commuting to work. Broken equipment needs to be serviced and/or replaced. Customers keep their homes warm during the winter whether interest rates are 3% or 7%.

We focus most of our attention on helping our clients maximize profitability; to do so they need to:

a) Earn strong margins per unit

b) Sell enough units

c) Run efficient operations

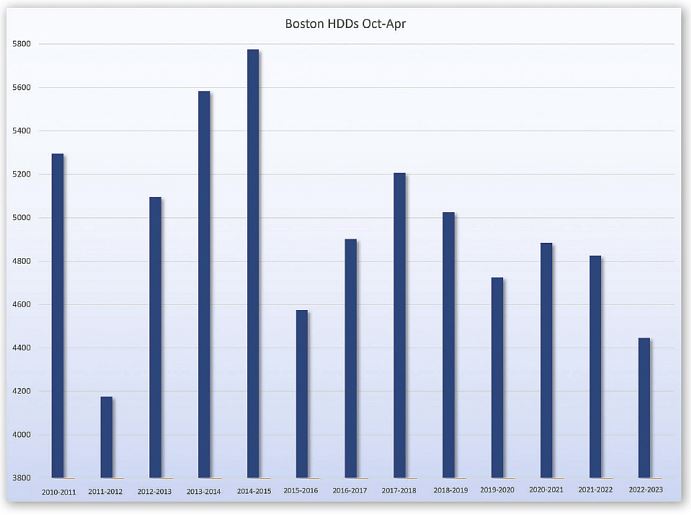

In this column, I want to focus on (b) selling enough units. All the planning in the world cannot help you accomplish this if Mother Nature does not cooperate. This past winter was very warm, and while the savings on overtime pay was a benefit, weather so mild that there were hardly any deliveries in the middle of the heating season was not ideal. It is hard to earn a living if you don’t sell enough gallons. Those sales aren’t impacted by your planning, pricing, exceptional service or wonderful website; rather, they are impacted by the temperature outside.

However, there is a way to generate revenue otherwise lost during a warm winter by hedging the volume through option purchases on the number of heating degree days (HDDs) in your area. Trading, or “hedging the weather” via weather derivative put options, can be an effective way to weatherproof your business.

The math is not complicated:

• There is a strike price: In this case, a floor on the number of HDDs

• There is a premium: The amount paid for the put option

• There is a payout per unit: If there are fewer HDDs than the floor, you get paid either a dollar amount per “lost” HDD or a dollar amount per “lost” gallon sold

In a cold winter, the premium paid for the puts option (the floor) would expire without any financial benefit, akin to auto insurance without a claim. On the other hand, if it were cold, you may have sold extra gallons to recoup part, or all, of the premiums paid to hedge against the potentially warm winter.

Hedging against warm weather in the winter is neither free nor do we consider it speculative. Its purpose, for our clients, is to provide a level of certainty in an uncertain world. We know that customers with a cap stay longer than those without a cap; customers on a budget stay longer than those who aren’t on a budget; the efficient use of drivers and delivery truck capacity keeps your costs of delivery down. High per-gallon margins can only do so much in a warm winter. Hedging your sales volume is definitely something that you and your trading advisors should consider. ICM

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or to authorize someone else to trade for you, you should be aware that you could lose all or substantially all of your investment and may be liable for amounts well above your initial investment.