Flowers aren’t the only thing in bloom this season. New York plans to implement an economy-wide Cap-and-Invest program in 2025. Massachusetts and Vermont plan to implement Clean Heat Standards (CHS) in 2026. New Jersey and Rhode Island have introduced legislation for CHS regulations. Other States won’t be far behind. What began as a trickle of “clean energy” legislation is predictably turning into a flood for the entire region. What will this mean for heating oil retailers and wholesalers? What can they expect and how can they start to prepare now?

If you’re a heating fuel retailer in New York, you’ll face several challenges when the state’s Cap-and-Invest program is implemented next year. While several important questions remain unanswered, the current version of the program will require all retailers that sell more than 100,000 gallons annually to purchase allowances for the fuel that they sell. These allowances will be purchased at a quarterly auction, before the retailer sells any of its fuel. The cash flow impact on your business is obvious: You’ll need access to additional capital upfront in order to purchase these allowances. Inevitably, the cost of these allowances will be priced into retail cost of fuel, increasing costs to New York consumers. We can also access higher accounts receivable (AR) balances as customers struggle to keep up with their bills, increasing the need for dealers to access capital regularly. If there’s a silver lining to be found in New York’s Cap-and-Invest program, it’s that dealers will know exactly how much the cost of these allowances will be, so they’ll be able to accurately price it into their fuel.

In contrast, Clean Heat Standards do not require additional capital for heating fuel retailers prior to selling the fuel. CHS regulations require heating fuel retailers to purchase credits on the open market or pay the alternative compliance payment price at the end of each compliance period. For example, for all heating fuel sold in 2026, a retailer would need to purchase and retire credits to meet compliance by June 2027. One of the challenges retailers will face in a CHS is knowing where to price their fuel to account for the credits they will have to purchase later. In the Massachusetts CHS, there will be two separate markets, with different compliance obligations and different alternative compliance payment price levels. The cost of compliance in each program will have to be considered by retailers when pricing their fuel.

One thing is certain: regardless of the program, the price of fuel will increase for consumers. In order for retailers to effectively prepare, it will be important to increase their access to capital prior to the program’s implementation. In both Vermont’s and Massachusetts’ Clean Heat Standards, renewable fuels are incentivized. In preparation for the beginning of these programs, retailers should be establishing relationships with biodiesel and renewable diesel suppliers, and should be blending biodiesel and renewable diesel into their fuel. New York State Research & Development Authority (NYSERDA) has not yet determined how it will treat renewable fuels in New York’s Cap-and-Invest program, but there is a possibility that blending biodiesel or renewable diesel will lower the number of allowances required to meet compliance.

Retailers in other States need to remain vigilant; New York, Massachusetts and Vermont will provide insight into what may be coming down the pike.

We can expect 2024 to be an extremely active year. New legislation in some States, new rules in others, and the imminent go-live of the New York, Vermont and Massachusetts programs will keep our company—and probably a fair number of Industry stakeholders—up at night. Diversified Energy Specialists will keep retailers, wholesalers and Industry stakeholders abreast of the various regulatory programs and their rule-making processes. If you’d like to join our email list to receive updates, email me at joe@diversifiedenergyspecialists.com. ICM

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.

As Massachusetts and Vermont get ever closer to the launch of their Clean Heat Standards, it’s easy to forget that other States are working on programs to accomplish the same goals. What we’ve said all along is coming to pass: As one State adopts a program, the likelihood that other States will follow only increases. This is an industry-wide issue that all dealers will eventually be required to be prepared for. Here’s what’s happening in the Mid-Atlantic States, specifically New Jersey and New York.

The Garden State

Since the start of New Jersey’s most recent legislative session, two “copycat” bills were introduced that closely mirror similar legislation in other States. On January 29, S2425 was introduced. This Low-Carbon Transportation Fuel Standard Bill is based heavily on California, Oregon and Washington State legislation and regulates the carbon intensity of transportation fuels (both diesel fuel and gasoline). New Jersey’s proposed legislation sets an emissions reduction target for the transportation sector of 10% below 1990 levels by 2030.

Just a few days later, A3374 was introduced in the State Assembly. This piece of legislation would establish a Clean Heat Standard similar to the early drafts of the Vermont and Massachusetts Clean Heat Standards. It places a compliance obligation on heating oil and propane retailers, natural gas utilities and electric utilities, requiring the obligated parties to reduce the carbon intensity of the heating fuel that they sell or sell less of it. If they do not, they will be required to purchase credits in an open market.

The significant concern in New Jersey—as it has been in States with similar programs—is that these bills will substantially increase the cost of energy and transportation for consumers.

The Empire State

New York’s Cap-and-Invest Program is in the rulemaking process and the program details are still being developed. However, new design aspects could hurt businesses and obstruct legitimate carbon reduction.

The Cap-and-Invest program is an economy-wide cap on emissions, with the goal of reducing emissions across all sectors in New York. This type of program holds auctions, where companies must purchase allowances—measured in metric tons of carbon dioxide—to continue their business operations. Recently, New York State Energy Research & Development Authority (NYSERDA) introduced an additional auction to be held towards the end of each compliance year. This auction will allow obligated parties to purchase additional allowances if necessary to meet compliance. As of now, there will not be a set number of allowances auctioned off and all allowances demanded will be supplied. Conceivably, a company could decide not to reduce emissions at all and simply continue to buy allowances to remain in compliance. If this change is included in the final regulation, it would essentially turn what was ostensibly a program to reduce emissions into a program that would serve as a cost increase on businesses with no certainty regarding the emissions reductions it would achieve.

We can expect 2024 to be an extremely active year in terms of new legislation, new rules to developing programs and the movement towards the implementation dates on Vermont and Massachusetts’ Clean Heat Standards. Diversified Energy Specialists will continue to keep retailers, wholesalers and Industry stakeholders abreast of the various regulatory programs and rule-making processes in the weeks and months ahead. If you’d like to join our email list to receive updates, email me at joe@diversifiedenergyspecialists.com. ICM

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.

In late November, the Massachusetts Dept. of Environmental Protection (DEP) released the draft framework for the State’s Clean Heat Standard (CHS). While the draft CHS represents a significant departure from the original concept, the implications for all other Northeast and Mid-Atlantic States remain. As I noted in the November/December issue of Indoor Comfort Marketing, Governors from eight different Northeast and Mid-Atlantic States have committed to exploring the possibility of a CHS. Additionally, Vermont has passed a CHS into law and New Jersey issued an executive order in early 2023 to create a CHS. All eyes remain on Massachusetts, and it is likely that programs in other States will closely mirror the final framework implemented in the Bay State.

What You Need to Know

First and foremost, the CHS draft calls for the program to be implemented in 2026. This is a year later than the original plan. Perhaps the largest change from the initial concept to the draft framework is in the creation of two obligations instead of just one. The draft framework calls for the creation of two different markets with tradeable credits. Both markets will have the same obligated parties—heating oil and propane retailers, natural gas and electric utilities—which will complicate the compliance process for all.

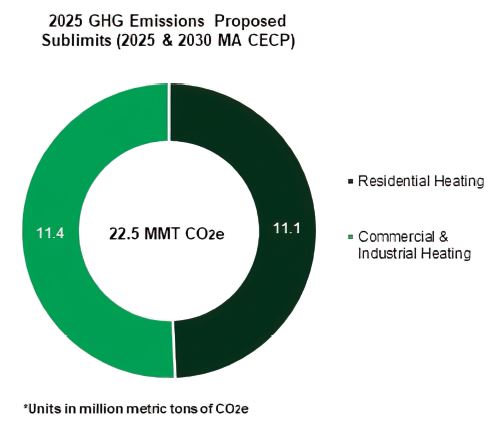

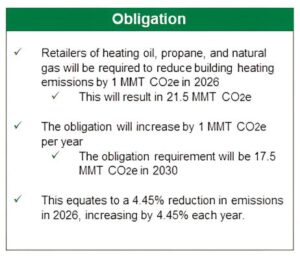

The first market created under the CHS is the Emission Reduction Standard. This standard requires that all heating oil and propane retailers—as well as natural gas utilities—reduce the amount of carbon they sell each year by a set percentage. The amount of carbon reduction required each year is one million metric tons, which equates to roughly 4.5% of the estimated carbon emissions from the heating of buildings in Massachusetts. For heating oil and propane retailers to meet compliance, they must sell less fuel, generate Emission Reduction Credits, purchase Emission Reduction Credits in the open market, or pay the Alternative Compliance Payment Price, which is set at $190 per metric ton of CO2e.

There are only two ways for stakeholders to generate credits in the Emission Reduction Standard. The first is by selling biodiesel. If a heating oil retailer sells biodiesel to its customers, the retailer will generate Emission Reduction Credits that can be used to meet compliance or can be sold in the market for a profit. The second way to generate Emission Reduction Credits is by installing heat pumps. Credits for heat pumps will be given to the end user, but the installer can enter into a contract with the end user to retain possession of the Emission Reduction Credits.

The second market created under the CHS is the Full Electrification Standard. Retailers of heating oil and propane, as well as the natural gas and electric utilities, will be obligated to convert a specified number of homes each year to electric heat pumps. The overall obligation across the state will be 20,000 fully electrified homes in 2026, increasing by 20,000 per year, resulting in 100,000 in 2030 and each year after. If the obligated parties do not electrify the specified number of residences to meet their compliance requirement, they must purchase Full Electrification Credits or pay the Alternative Compliance Payment Price, which will begin at $6,000 per home and increase to $10,000 per home in 2030. Additionally, 25% of Full Electrification Credits must come from low-income households. Full Electrification Credits from low-income households will have an Alternative Compliance Payment Price of $12,000 in 2026, increasing to $20,000 in 2030.

Since this is a draft framework, the pieces are still moving. As of this writing, the DEP is taking comments and I am deeply engaged in providing input on behalf of the industry. What is certain is that there will be a whole new world in Massachusetts in just a few years. While it may be scary for some, heating oil retailers will have a pathway to success and profitability through the blending and distribution of biodiesel.

For those of you who operate in Massachusetts, I encourage you to stay up-to-date on the CHS and become engaged in the process. For those of you who operate in other New England or Mid-Atlantic States, it is critical that you view Massachusetts as the canary in the coal mine. This CHS (or something like it) will most likely be coming to your State soon.

Diversified Energy Specialists will be keeping retailers, wholesalers and industry stakeholders abreast of the various programs and their rule-making processes in the weeks and months ahead. If you’d like to join our email list to receive our updates, email me at joe@diversifiedenergyspecialists.com. ICM

Renewable Energy Insights is authored by Joe Uglietto, consultant with a focus on emissions reductions and renewable energy innovation.

State regulators are quickly approaching a fork in the road when it comes to developing Clean Heat Standards (CHS) and compliance markets. They will either choose program guidelines that are designed only to incentivize the electrification of buildings, or they will choose program guidelines that are designed to reduce carbon emissions from the thermal sector from all technologies.

Let’s take a look at what’s happening right now in Massachusetts. The Department of Environmental Protection (DEP) has indicated that its CHS is designed based on the California Low Carbon Fuel Standard (LCFS). However, there are many differences between these two programs. One example is that the LCFS treats all emissions reductions equally; each ton of carbon dioxide reduced is worth one credit regardless of the energy source. The Massachusetts DEP indicated during its Aug. 15 public hearing that it is leaning towards a “yard stick” method that would assign the value of one credit as the equivalent of one electrified home. While the stated goal of the CHS is to reduce emissions from the thermal sector, the adoption of this “yard stick” method to value credits would indicate that the actual goal of the CHS is to electrify all buildings in Massachusetts, not maximize greenhouse gas reductions.

Digging a bit deeper into the suggested program guidelines, we find that in the Massachusetts CHS’s first discussion document published a few months ago, the DEP suggested a mandate that all heating fuel suppliers convert 3% of their customer base annually to Air Source Heat Pumps (ASHP) or face a large fine. In this scenario, whether the customer wants to switch to heat pumps or not is irrelevant. The DEP has also considered treating electricity as carbon-neutral. The fuel used to power our electric grid would be irrelevant and all electricity would be considered to be renewable—despite the reality that more than half of winter electric generation would continue to come from natural gas. To cap things off, heating fuel suppliers would be required to either reduce the carbon intensity of their fuel or lower their sales by 29% in 2025 and by 49% in 2030. There would be no time built in for capital investment or to effect a transition as was afforded to the power and transportation sectors.

The problems with these kinds of program guidelines are myriad. Tracking fuel from out of State, regulating out-of-State entities, accurately carbon-scoring each fuel and a large compliance obligation in year one are just a few problems that come to mind. Let’s not forget to mention the harm brought to the end-user or consumer, who will bear the financial burden of these programs and be stripped of the ability to choose how best to heat and cool their home.

It is absolutely a possibility that these guidelines will be written into the CHS in Massachusetts. However, this story is far from over. DES—along with other stakeholders—has been heavily engaged in the process. It is critical that our industry continues to shine a light on the deeply negative outcomes that may result from these guidelines. Only then can we convince regulators that the greatest promises for effective Clean Heat Standards are ones that support a realistic approach. ICM

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.

Our Industry must deal with enormous threats to its existence each and every day. Many of us have gotten used to the usual suspects—State legislatures considering electrification mandates, clean heat standards that regulate all heating fuels and electric vehicle and electric equipment incentives to entice our customers to make the switch. However, another approach is gaining steam and will add to the squeeze should it become commonplace. This new-ish threat comes to us in the form of Building Performance Standards.

A Building Performance Standard is yet another attempt to regulate emissions, deployed primarily at the State and local levels. Colorado, Maryland and Washington State have already enacted Building Performance Standards. Boston, MA, New York City and Washington, D.C. have joined the party at the local level; Cambridge, MA, is expected to enact its own Building Performance Standard later this year.

The goal of a Building Performance Standard is to reduce emissions in commercial and industrial buildings. This is a worthy goal, to be sure, but as with the rest of the electrification plans that fit into the “nice idea, not so nice results” category, the devil—and the cost—is always in the details. Let’s take a look at a one example: Boston’s Building Performance Standard.

Building Emissions Reduction & Disclosure Ordinance (BERDO) is Boston’s recently enacted standard. BERDO sets requirements for all qualifying large buildings within the city limits to reduce their greenhouse gas emissions gradually, with a goal of net zero by 2050. Buildings larger than 20,000 sq ft or with 15 or more individual dwelling units are required to reduce their carbon footprint on an annual basis. All buildings must be carbon neutral by 2050, but the annual reduction requirements vary based on building use. Healthcare facilities, universities, multi-family housing, manufacturing/industrial and all other building uses will have different reduction requirements. All qualifying buildings will be required to report their emissions on an annual basis to the State. The entire carbon footprint of the building is measured—electricity, heating, hot water and any other activity that produces greenhouse gas emissions. If a building does not reduce its emissions by the required amount each year, Renewable Energy Credits (RECs) will need to be purchased or the building owner will be required to pay a fine in the form of an Alternative Compliance Payment (ACP) per ton of carbon dioxide emitted above the requirement. Unfortunately for these buildings, there is no incentive for reducing emissions beyond the minimum requirement.

As we have seen in virtually every State that has attempted to adopt narrow policies or regulations to force electrification on its consumers and businesses, the unintended—and in some cases, intended—consequences may be significant. Building owners will incur increased costs whether they are actively complying with the standard or paying for RECs or fines. In either case, operating costs will increase, rent will increase and consumers will bear the brunt of these regulations.

Building Performance Standards are just another example in a long line of legislative and regulatory threats to our Industry that will squeeze our businesses, impact consumers and have a negligible impact on reducing emissions. It will be critical that we remain vigilant as individual business leaders and as an Industry to vocally oppose these poorly thought-out regulations whenever and wherever we can. ICM

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.

The energy industry is undergoing an enormous transition and the number of States that are considering regulatory programs to achieve their carbon-reduction targets is growing by the week. Over the next few years, heating oil, propane and natural gas companies across the Northeast and Mid-Atlantic will be dealing with increasing requirements to reduce their carbon impact. We can expect that these new regulations will affect the price of our products and the day-to-day operations of how nearly every energy company conducts its business. Here’s a quick snapshot of what’s on the table around the region.

Massachusetts recently released a Clean Heat Standard (CHS) discussion document and straw proposal, with the goal of implementing a CHS by the beginning of 2024. A CHS is a market-based regulatory program that would require heating fuel companies to reduce the carbon intensity of their fuel by a certain percentage each year, typically aligning with the State’s greenhouse gas reduction goals. If these companies reduce the carbon intensity of their fuel by more than the goal each year, by blending biodiesel or other renewable fuels, they will generate credits that can be sold in the market for a profit. If these heating fuel companies do not reduce the carbon intensity of their fuel by the goal each year, they will be required to purchase credits in the market to meet the compliance requirements within the program.

Legislation for a Clean Heat Standard in Vermont was passed by the State House in March and, as we go to press, is likely to be voted on in the State Senate in April. In New Jersey, Governor Murphy issued an Executive Order that required the Board of Public Utilities to conduct an 18-month study on the adoption of a Clean Heat Standard. Maryland has hired the Regulatory Assistance Project, the consulting firm that is helping design the Clean Heat Standards in Massachusetts and Vermont, to provide guidance in meeting its greenhouse gas reduction goals. Pennsylvania and New York are considering Clean Fuel Standards, which are transportation-focused regulatory programs aimed at achieving carbon reduction. Both States are considering including heating fuels as well.

Additionally in New York, there is a strong push to implement an economy-wide “Cap & Invest” program, which will cap the greenhouse gas emissions that businesses and facilities can produce each year. These businesses will have to purchase allowances at auction for the right to continue operating their business. A Washington Post article in April estimated that New York’s “Cap & Invest” will increase the cost of transportation fuels by 61% and increase the cost of heating a home by 80%. It remains to be seen whether the cost impact will deter or slow down the move to adopt such an impactful program.

While many of these programs are not yet finalized—either because details are still being worked out or legislation has not yet passed to establish them—it is virtually certain that our industry will be dealing with these kinds of programs in short order. The first step for fuel companies is to recognize and embrace that change is coming, and in ways that are likely to squeeze your business. The second step is to prepare for this eventuality by developing a clear-eyed strategy to succeed in this new regulatory environment.

There will be companies that take full advantage of the new regulations in their States. Make sure that your company is one of them. ICM

———————————————————————————————————————————————————————————————————

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.

Electrify everything” is gaining ground at the Federal level and in many Northeast States. Heat pump incentives, clean energy tax credits and legislation to ban fossil fuels are all on the table in some shape or form. In States such as Massachusetts and Vermont, policies to create new Clean Heat Standards have either passed or are likely to pass in the coming months.

A key driver of the electrification movement in 2023—and likely for many years into the future—is the Inflation Reduction Act (IRA). The recently passed IRA will provide substantially higher incentives for homeowners to install electric heat pumps than what has been offered in the past. Rebates for low-income households can reach up to $14,000 for an air-source heat pump system. These rebates will make converting to heat pumps financially competitive in comparison to the installation of new, higher efficiency, low carbon liquid fuel and propane systems.

Additionally, several Northeast States have earmarked millions of dollars of IRA funds for broad-based consumer education campaigns to promote heat pumps and improve perceptions of heat pumps and heat pump technology among the public. The use of IRA funds for consumer outreach and education is likely in response to the relatively slow adoption of heat pumps thus far. Massachusetts provides an excellent example: the State set a target of installing 100,000 heat pumps beginning in 2020 with the goal of one million heat pump installations completed by 2030. According to reporting conducted by The Boston Globe, 461 heat pumps were installed in 2020.

However, the slow adoption of heat pumps hasn’t given electrification advocates pause about the merits of wholesale electrification. The “carrot” of rebates and incentives will likely give way to the “stick” in the form of attempted non-electric fuel bans and clean heat standards. A State-by-State clean heat standard would require the heating oil, natural gas and propane industries to reduce the carbon intensity of their fuel, sell less of their fuel or pay others to reduce the carbon intensity from heating technologies. Clean heat standards would increase the cost of energy and further incentivize the installation of cold-climate air-source heat pumps.

It is crucial that every stakeholder in the industry prepare for a future that completely embraces renewable, low-carbon heating fuels, a future of clean heat standards and carbon reduction, and a future that will require a strategic and forceful response in the form of political advocacy and consumer outreach.

Renewable Energy Insights is a regular column by Joe Uglietto, President of Diversified Energy Specialists, consultant to the industry with a focus on emissions reductions and renewable energy innovation.